Conversational AI in insurance: Transforming the landscape of tomorrow

In this article, we’ll explore AI use cases in insurance, ranging from automating repetitive queries and fostering education among agents to enhancing the self-servicing experience for policyholders. We’ll also spotlight how health insurance AI, especially insurance chatbots, is revolutionizing the customer experience, especially with AI in health insurance.

Have you ever found yourself trapped in a loop of jarring hold music while trying to claim insurance? Or perhaps waded through endless forms, feeling more like a statistic than a valued customer? These are old-fashioned experiences in a world where technology offers so much more. With conversational AI, chatbots are no longer just a promising prospect; they’re here, making ripples across the insurance industry with tangible, real-world impact.

A landmark study shows that 95% of insurance executives expressed intent to invest in AI capabilities. The question is no longer about whether AI will play a role in insurance but how deep and transformative that role will be. So, as we navigate through insurance coated in the brilliance of AI, let’s uncover the many ways conversational AI is reinventing the industry.

Introduction of conversational AI in insurance

The golden era of insurance was synonymous with personalized touchpoints. Policyholders once shared an unspoken bond with agents, expecting individualized attention, especially in dire times of claims. Fast-forward to today, where data-driven strategies dictate the industry’s direction. Despite having a vast reservoir of customer information, there’s an undeniable drift from intimate one-on-one interactions to a more distant call center dynamic. This transition has made the industry more efficient but at the price of making the customer feel more like a number than a cherished client.

Imagine a scenario where a claimant effortlessly uploads image-based documentation via their smartphone or a potential policyholder receives a virtual tour of their proposed policy, all through the ease of AI-driven platforms. The experience goes beyond just automation; it’s about using AI to predict, enhance, and enrich every interaction, making every touchpoint feel as personalized and human-like as it once was.

Related must read:

- Conversational AI – A complete guide for [2023]

- Automation in Insurance: Examples, Benefits and More

- World’s largest Insurer sails through pandemic with superior CX and reduced costs

Conversational AI utility for different insurance vertical

As the insurance industry continues to evolve, leveraging technology to enhance customer experience has become paramount. Conversational AI stands at the forefront of this transformation, offering tailored solutions across different insurance verticals. Here are a few examples:

| Insurance vertical | Conversational AI utility |

| Health insurance |

|

| Auto insurance |

|

| Life insurance |

|

| Property insurance |

|

| Travel insurance |

|

| Pet insurance |

|

Conversational AI use cases in insurance

The insurance sector is vast and diverse, and navigating it requires adopting sophisticated digital tools. Conversational AI is one such tool that can significantly improve various facets of the insurance journey for both policyholders and service providers. Here, we explore eight compelling use cases for conversational AI in the insurance domain, each providing a unique perspective on how this technology can reshape the industry.

1. Automating repetitive queries

Given the vast and intricate nature of insurance products, customers often seek clarification. Conversational AI offers a remedy, automating responses to the most frequent and repetitive questions. This automation relieves the burden on customer service teams and presents customers with immediate, accurate answers.

Example: A policyholder might ask, “What does my premium cover?” Instead of waiting in a queue for a human agent, Yellow.ai’s conversational AI platform promptly provides the details, ensuring customer satisfaction while freeing up agents for more complex tasks.

2. Education and awareness for agents servicing

Agents are the primary point of contact for many policyholders. However, staying updated with the ever-evolving insurance policies, premiums, and clauses can be challenging for insurance agents. Conversational AI assists by granting agents instant access to this knowledge. They can retrieve the most recent data through simple commands, ensuring they’re always informed.

Example: An agent, unsure about the new clauses in a health insurance policy, quickly queries the conversational AI interface. In seconds, they receive comprehensive details, allowing them to address customer queries confidently.

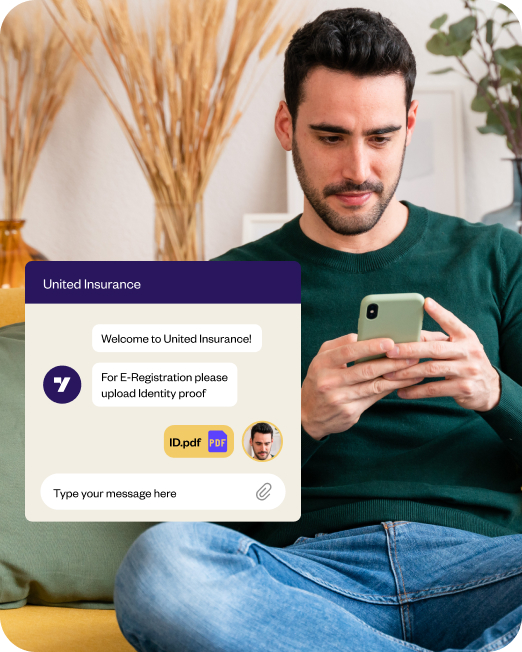

3. Self-servicing for policyholders

The empowerment of policyholders is a significant stride towards a more user-centric insurance industry. Conversational AI facilitates this by enabling policyholders to manage their insurance journey independently. This self-servicing capability proves invaluable for relatively straightforward insurance products, such as travel or motor insurance.

Example: A traveler, keen on purchasing travel insurance for an upcoming trip, interacts with an AI assistant embedded in the insurance provider’s app. They compare policies, ascertain the best fit, and finalize their purchase — all without human intervention.

4. Boosting call center operations efficiency

Contact centers, while indispensable, face the challenge of efficiently handling vast volumes of queries. Conversational AI elevates their productivity. By automating a substantial number of inquiries, AI enables agents to focus on more complex issues while simultaneously handling multiple sessions.

Example: In a contact center using Yellow.ai, the AI chatbot efficiently manages routine queries about policy details. The human agents, meanwhile, concentrate on resolving intricate cases, ensuring optimal use of resources.

5. Improving the customer journey

The digital transformation wave has underscored the importance of refining the customer journey. With conversational AI, insurance providers can offer seamless, efficient, personalized experiences across various channels, ensuring customer loyalty and reducing operational costs.

Related read: What Is a Customer Journey Map and How to Create

Example: A policyholder, initially overwhelmed by various services, finds solace in a conversational AI guide. This virtual assistant walks them through processes, offers personalized suggestions, and ensures their journey is smooth from start to finish.

6. Streamline insurance business operations

Efficiency isn’t just a front-end priority. From claims processing to fraud detection, backend operations benefit immensely from conversational AI. It augments the speed and accuracy of tasks and empowers agents with data-driven insights.

Example: A backend employee tasked with claims adjudication uses the AI system to filter relevant data, significantly reducing processing time quickly. Similarly, alerts regarding potential fraud cases ensure proactive measures.

7. Accelerate the purchase journey for prospective policyholders

For potential customers, the initial research and purchase phases are crucial. Conversational AI accelerates this journey, guiding prospects through product exploration, comparison, and eventual purchase, especially for straightforward insurance products.

Example: A prospect exploring motor insurance options engages with an AI assistant. Through personalized product recommendations, document submission assistance, and seamless payment processes, they swiftly transition from a prospect to a policyholder.

8. Use keywords to observe opportunities and trends

Conversational AI offers a treasure trove of data, allowing insurance providers to discern patterns, opportunities, and trends through keyword analysis. It optimizes marketing strategies and also identifies potential areas of growth or concern.

Example: Through analyzing interactions, the AI identifies a spike in queries about “home insurance discounts.” Recognizing this trend, the marketing team crafts a targeted campaign, capturing the attention of this interested audience segment.

The future of conversational AI for the insurance industry

As the insurance industry finds itself at the crossroads of technological evolution, the trajectory of conversational AI points towards a landscape redefined by efficiency and customer-centricity. Advancements in Natural Language Processing (NLP) continue to fine-tune the nuances of virtual agent interactions, enabling insurance contact centers to delegate routine tasks to AI, thus liberating human agents for more intricate and value-driven activities.

Highlighting this shift, a KPMG survey revealed that 68% of insurance CEOs are channeling their resources towards customer-focused technologies like AI chatbots. With industry leaders like McKinsey spotlighting AI’s potential to curtail customer service costs by up to 30%, this digital evolution has a clear financial incentive.

The promise of conversational AI goes beyond cost savings. In a business where customer loyalty translates to significant revenue increments, improving the user experience is paramount. The fact remains that retaining a customer is five times more cost-effective than acquiring a new one. As the workforce embraces a more blended work model, the need to seamlessly integrate technology throughout the customer journey becomes more urgent than ever, marking conversational AI as a cornerstone for the industry’s future.

The final thoughts on conversational AI in insurance

Conversational AI is the future of the insurance sector. By seamlessly integrating platforms like Yellow.ai, insurance providers can ensure they’re at the forefront of this transformation, offering unparalleled service and efficiency. The examples mentioned above are just the tip of the iceberg. As AI continues to evolve, its applications in the insurance domain will only expand, heralding an era of unparalleled innovation and customer satisfaction.

Interested in experiencing the transformative power of conversational AI firsthand? Book a demo with Yellow.ai today and witness the future of insurance.